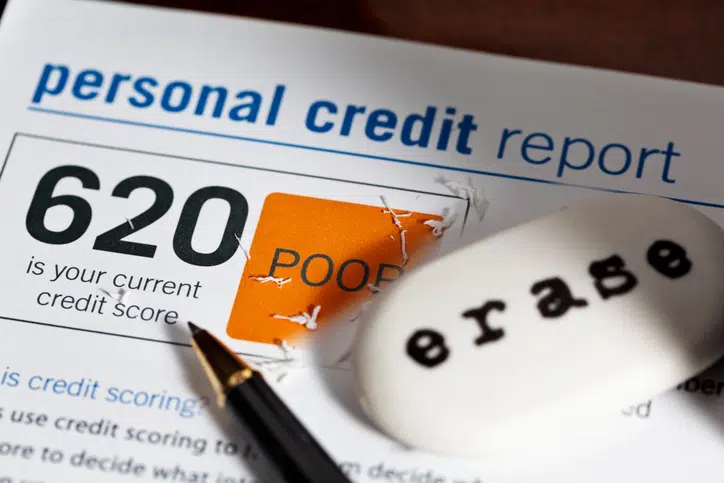

Have Errors and Mistakes Removed from Your Credit Reports

Florida consumers can instantly improve their credit scores by cleaning up their credit reports. It’s a fact that even those who manage credit responsibly don’t always have the highest credit scores. This is because credit report errors are incredibly common, and these mistakes bring credit scores down. However, at Credit Repair Lawyers of America, we work to remove credit score harming errors from credit reports.

We write and send dispute letters to the appropriate credit reporting agencies. Under the Fair Credit Reporting Act (FCRA), the credit bureaus must investigate and address these disputes within 30 days. If a credit reporting agency fails to cooperate, we sue them. This gives us more muscle to fix your credit reports, and the FCRA allows us to collect our fees and costs from the defendants in settled cases.

Mistakes Often Found on Credit Reports

The truth is that about 80% of credit reports are flawed in some way. Credit report errors are so common because creditors and credit reporting agencies are often careless with their consumer information. This mishandling leads to many different kinds of errors, but some mistakes are more common than others.

For example, we encounter a lot of expired debt on the credit reports we review. These are negative items such as charge-offs, repossessions, and bankruptcies that are too old to be reported. We also see a great deal of discrepancies among the credit bureaus. Namely, accounts are updated on credit reports from two of the major credit bureaus, but not the credit report from the third agency. This is how a “paid” account shows up as “unpaid” and costs a consumer credit score points.

Mismerged data is another big credit reporting problem in Florida. This is when account information belonging to two consumers with similar names gets confused. For instance, John Smith Junior’s unpaid bills ends up on John Smith Senior’s credit report. Sometimes credit report items are wrong because lenders contribute incomplete or inaccurate consumer information.

Unfortunately, one of the most common credit report issues facing people from Florida has little to do with lenders or the credit bureaus. Instead, the fraudulent charges and accounts that pop up so much are due to incidents of identity theft. Of course, if these items are disputed and not removed in a timely manner, the blame falls on the credit reporting agencies.

You Have a Right to Error-Free Credit Reports

Luckily, no Florida resident has to live with damaged credit reports. In fact, the Fair Credit Reporting Act (FCRA) entitles all U.S. consumers to accurate credit files. So, if there are flaws lurking on your credit reports and harming your credit score, give us a call. The experienced attorneys at Credit Repair Lawyers take pride in the work they do for consumers, and are happy to offer these services at no charge. In some settled cases, our clients even receive damages for their troubles.

We also offer free credit report reviews to potential Florida clients. Just send us the most recent copies of your credit reports from www.annualcreditreport.com, and we will go over them with you. If we find errors, we will write dispute letters on your behalf and mail them to the correct credit bureau(s). In cases where credit reporting agencies are uncooperative, we file lawsuits under the FCRA, and we don’t stop until your credit reports are clean.

Talk To A Credit Repair Lawyer for Free

Let’s start the conversation about how Credit Repair Lawyers of America in Florida can help you. Whether you need assistance with your credit reports or an abusive debt collector, we’ll work hard to find a quick solution. We also offer credit report recovery services to victims of identity theft. Call us at (786) 933-8520 or send Gary Nitzkin a message at [email protected] to set up a free, no-obligation consultation.

Sue. Settle. Smile.

Credit Repair Lawyers of America

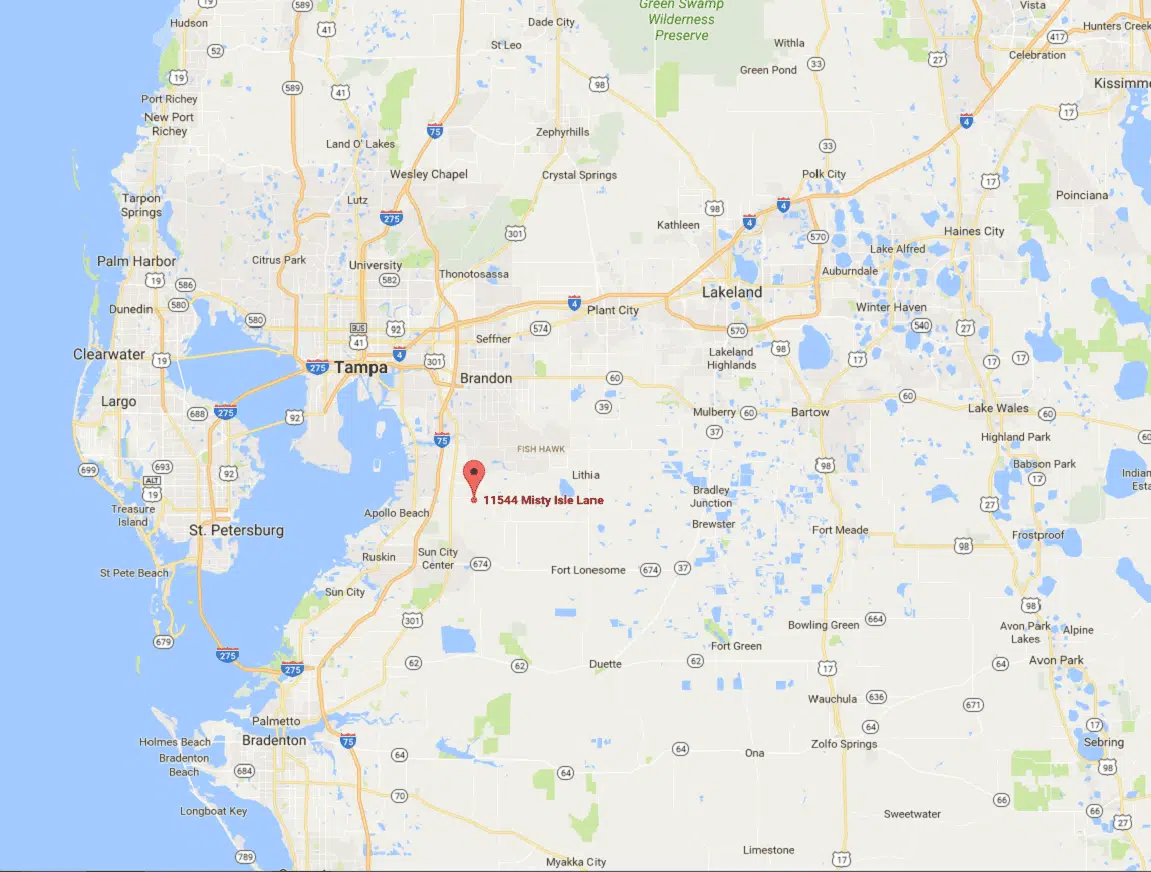

1544 Misty Isle Lane

Riverview, FL 33579

[email protected]

creditrepairlawyersam.com

HOURS OF OPERATION

Monday to Friday: 8:30 AM to 5:00 PM

Weekends: By Appointment Only