Why Clients Trust Our Services

Carl Schwartz

We started out as a law firm back in 1990 and began offering credit repair services in 2008. We have an excellent track record of success, and our glowing reviews from former clients speak for themselves. Now, we’re pleased to offer our full range of services to New Yorkers with credit issues. If you are a victim of identity theft or debt collector harassment, or have errors on your credit reports, we can help.

Credit Repair

A lot of New Yorkers have flawed credit reports because creditors and credit reporting agencies frequently make mistakes. As a law firm, we work under the Fair Credit Reporting Act (FCRA) to remove credit report inaccuracies. Of course, we always try to do this “this nice way” at first, but lenders and credit bureaus don’t always cooperate. When this happens, we file lawsuits against them. Then, when we win, the FCRA forces the defendants pay or costs and fees. In fact, this is why our clients never pay anything out of pocket for the work we do.

Identity Theft Damage Repair

Victims of identity theft almost always sustain credit report damage. So, removing fraudulent charges and bogus accounts from credit reports is a necessary part of identity theft recovery. However, creditors and credit reporting agencies are often less than helpful in the process. Their lack of cooperation slows down credit repair efforts, but we can get identity theft victims back on track. At Credit Repair Lawyers of America, we know how to force lenders and credit bureaus into action. We’ll also make the whole process easier for you by writing your dispute letters on your behalf and organizing your documents.

Help with Debt Collector Harassment

Even if you owe money on past-due debts, debt collectors don’t have the right to use abusive tactics against you. Too many New Yorkers say nothing about debt collector harassment because they are ashamed of their situations, but they don’t have to take the abuse. The Fair Debt Collection Practices Act (FDCPA) protects New York consumers against harassing debt collectors. If a debt collector insults, threatens, or calls you at inappropriate times, we will make them stop. Then, when we sue them on your behalf for FDCPA violations, we’ll turn the tables and make them pay you for damages.

How Our Legal Services Work

The statutes under which we work, the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA), require the defendants in successful actions to cover our costs and fees.

Talk To A Credit Repair Lawyer for Free

Let’s start a conversation about how we can help you with your credit issues. Call attorney Carl Schwartz at (646) 770-2891 to schedule a free, no obligation consultation, or email him through our contact page.

Sue. Settle. Smile.

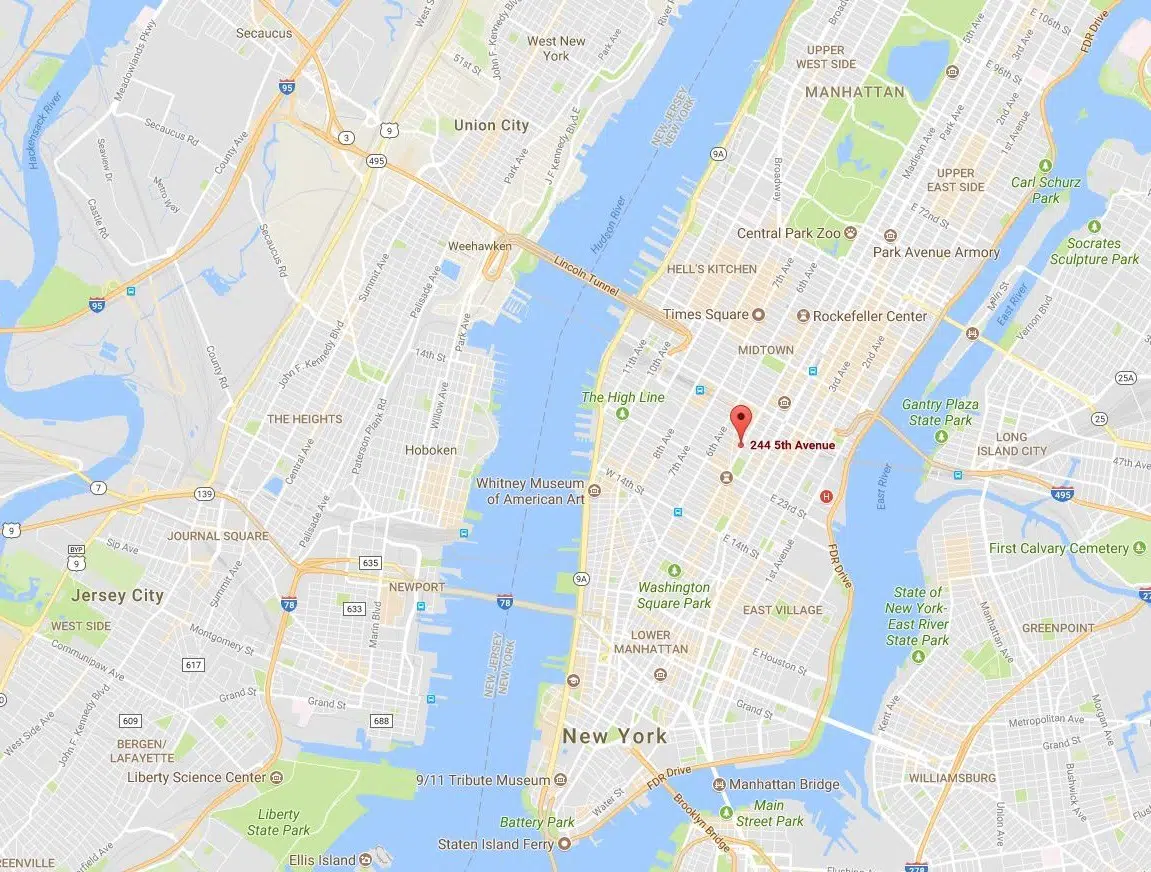

Credit Repair Lawyers of America

244 Fifth Avenue Suite 2300

New York, N.Y. 10001

[email protected]

creditrepairlawyersam.com

HOURS OF OPERATION

Monday to Friday: 8:30 AM to 5:00 PM

Weekends: By Appointment Only