Why Arizona Consumers Trust Us for Credit Repair

Our law firm has been around since 1990, and we’ve been fixing credit reports since 2008. We also stop debt collector harassment and repair credit reports damaged by ID theft. Our success has allowed us to expand to other states which now includes Arizona. Now that we’re here in the Grand Canyon State, we look forward to helping new clients solve their credit issues.

Legal Credit Repair

Most Arizonians need credit repair, even if they don’t realize that their credit reports are damaged. The truth is that about 80% of credit reports are flawed in some way because creditors and credit reporting agencies make mistakes. They often mishandle consumer info, then their carelessness leads to credit report errors and, a lot of the times, lower credit scores.

At Credit Repair Lawyers of America in Arizona, we work under the Fair Credit Reporting Act (FCRA) to remove errors from credit reports. The FCRA entitles Arizona consumers to accurate credit reports, and our firm supports consumer rights with our legal services. Our status as a law firm enables us to go the distance with our credit repair efforts. In short, if credit reporting agencies and creditors won’t cooperate with our requests to remove mistakes, we file lawsuits against them. In successful actions, the defendants must pay both our costs and fees. This is why our clients always pay nothing.

Credit Report Repair after Identity Theft

Victims of identity theft are usually left with damaged credit reports. These consumers rely on creditors and credit bureaus to remove fraudulent charges and bogus accounts from their credit files. However, these organizations don’t always cooperate. Fortunately, the experienced attorneys at Credit Repair Lawyers of America have the legal muscle to force both lenders and credit reporting agencies into action. With our help, identity theft victims get their credit reports cleaned up faster and with less hassle.

Stop Debt Collector Abuse and Harassment

Debt collector harassment is a common problem in Arizona because a lot of folks are unaware of their rights. These consumers should know that, under the Fair Debt Collection Practices Act (FDCPA), debt collectors are not allowed to use abusive tactics. Among other things, debt collectors may not threaten you, call at odd hours, or use harsh language against you. So, if a debt collector harasses you in any way, we can make them stop, and that’s not all. The FDCPA may also require the offending debt collector to pay YOU for damages.

Our Credit Repair Services

We’re also happy to explain our business model because it is wonderfully simple. Under both the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA), creditors, credit reporting agencies, and debt collectors are required to cover our costs and fees if we bring lawsuits against them and win. This is why our clients never pay the bill.

Talk To A Credit Repair Lawyer for Free

Let’s start a conversation about how we can help you with your credit issues. Call attorney Trinette G. Kent at (480) 771-6001 to schedule a free, no obligation consultation, or email her through our contact page.

Sue. Settle. Smile.

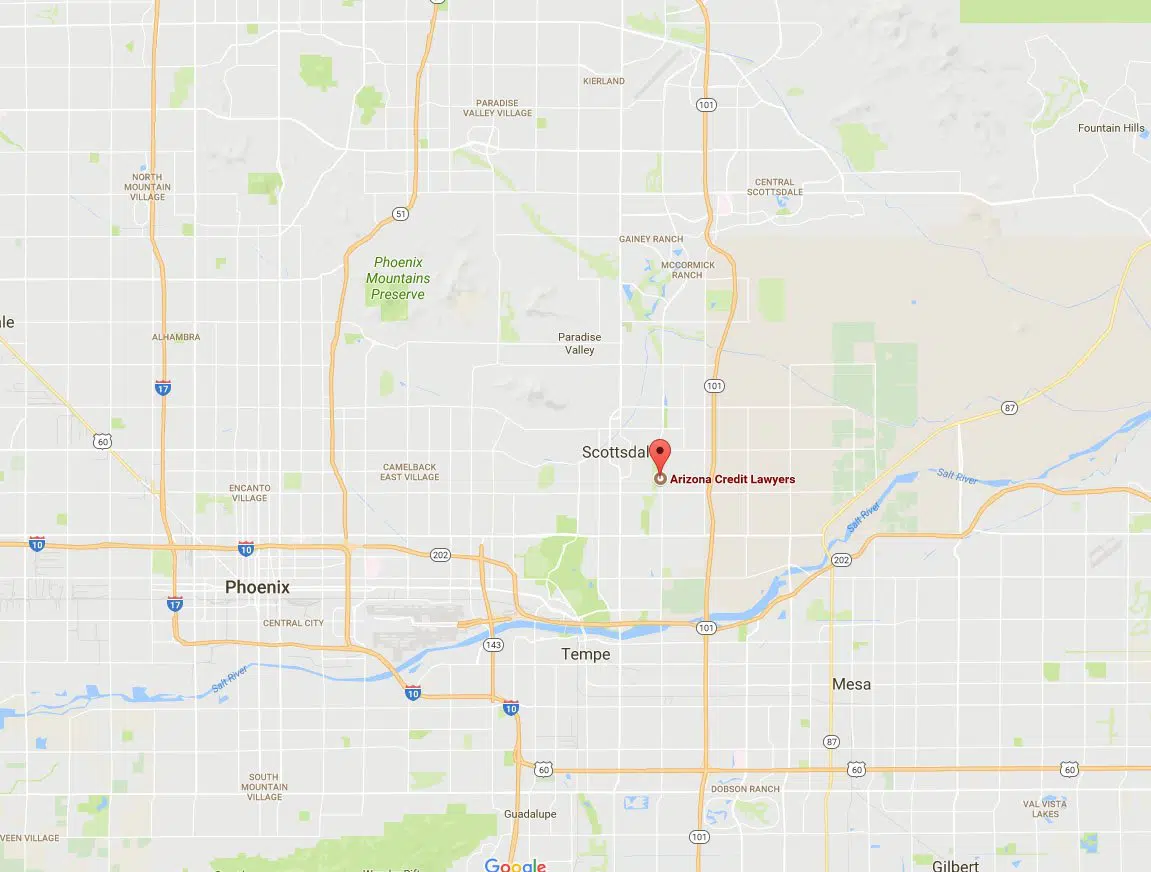

Credit Repair Lawyers of America

3260 N Hayden Road, Suite 210-305

Scottsdale, AZ 85251

[email protected]

creditrepairlawyersam.com

HOURS OF OPERATION

Monday to Friday: 8:30 AM to 5:00 PM

Weekends: By Appointment Only