We are a credit repair law firm. Unlike a credit repair company that only sends letters and charges you fees, we send a singular letter and then follow up with a lawsuit if the credit reporting agency and/or lender don’t fix the problem. Unlike Lexington Law, we file lawsuits and do not charge you any out of pocket fees. We collect our fees from the defendants that we sue. If we fix your credit report from our dispute letter, then you owe us nothing

Our California Credit Repair Firm Is Here To Help

We have been helping people fix errors and mistakes on their credit reports since 2007. Over the years, we have not only learned how lenders, debt collectors and credit reporting agencies can wrongfully damage your credit report, we have learned the most expeditious techniques for fixing this damage. We also know how to make them pay your fees and costs so our services cost you nothing out of pocket.

Free Credit Report Review & Repair

Join our “3 for Free” program where you will send up to 3 dispute letters out on your behalf at no charge to you. In our experience, if these letters do not fix the problem, then a lawsuit is the best way to get your credit report cleaned up. Don’t worry about our fees and costs as we charge them to the defendants. Under the law, they have to pay our fees and costs

Filing Lawsuits Against Credit Reporting Agencies

We have literally filed thousands of lawsuits against the credit reporting agencies over the years. We have taken their depositions on numerous occasions and have gained insight as to how they work. Equally, we know how they fail to work and where they make mistakes. You can trust our many years of experience litigating against the credit bureaus to fix your credit reports and raise your credit score.

Stop Debt Collector Calls & Harassment

Debt collectors and debt buyers have run amok over the years. Perhaps that is why there is so much regulation of debt collectors. Still, many of them don’t pay attention to the rules that govern them and that is when we sue them. If you have been contacted at work or during strange hours, or if you have been threatened by a debt collector, call us for a free, no obligation consultation. We are happy to advise you of your rights. Our services will not cost you anything out of pocket.

Our 3 For Free Credit Repair Program

Join our “3 for Free” program and let us send up to 3 dispute letters on your behalf. If our letters fix your credit issues, you will not owe us a thing. If our letters do not fix the issue, let us sue the credit bureaus, debt collectors or lenders and again, you still won’t owe us anything. Under the law, our fees and costs are paid by the defendants in any successful action.

Forcing Credit Card Companies to remove Fraudulent Charges

Credit card companies have been loaded with disputes ever since the birth of online shopping. There is a special law called the Fair Credit Billing Act that allows you to dispute items that you never received or ordered. You can actually force the credit card company to credit your account for these bogus charges. The only problem is that many of them refuse to follow the law. We can make them credit your account and pay your fees and costs so it costs you nothing out of pocket.

We Focus on Helping Consumers Fix Their Credit Scores

Identifying Questionable Negative Items That Are Wrongfully Hurting Your Credit score

Did you know that 80% of all credit reports have errors on them? Half of those errors depress one’s credit score. We have focused our practice on helping consumers get their credit reports corrected so they can get jobs, cars and homes. The credit bureaus are large multi billion dollar corporations and to them, you are a number. To us, you are a fellow human being who deserves the credit that you have worked hard to earn.

If The Derogatory Mark Is An Error, We Can Send a Dispute Letter For The Credit Bureaus

Just because there is a derogatory mark on your credit report does not mean that it’s accurate. In fact, there is a good chance that it’s not accurate or that the creditor cannot prove that it’s accurate. The burden to prove accuracy is on the credit bureau and the lender or collection agency that is reporting it. If you have negative items on your credit report, let us review it with you. We can usually find things on credit reports that should not be there that others cannot.

Our California Credit Lawyers Fix Peoples Credit Reports In a Legally & Trustworthy Manner

The Fair Credit Reporting Act Protects Consumers

We have been fixing credit reports since 2007. We do by writing a singular letter to credit bureaus. Unlike credit repair companies and Lexington Law, we don’t charge you monthly fees. In fact, we don’t charge you any out of pocket fees at all. We are so confident of the lawsuit that we will bring on your behalf that we put our money where our mouth is. We only look at what we collect on your behalf to get paid. If you are paying for credit repair, you are paying too much. Call us today.

Accurate & Free Credit Report Review In California

Let us review your credit reports for free. Over the years, we have reviewed literally thousands and thousands of credit reports. We see trends in credit reports that sometimes are disadvantageous to consumers and are illegal. We challenge those things including anything that is not reporting accurately on your credit report.

Defend Your Rights Against The Credit Reporting Bureaus

If You Find Errors On Your Credit Report, You Are Entitled To Dispute The Issue

The Fair Credit Reporting Act is the law that protects consumers’ credit reports. Under the law, you alone are in charge of making sure that your credit report is accurate. If you find an inaccuracy or if we find one, its up to you/us to bring that inaccuracy to the attention of the credit bureau. They then have 30 days to fix that inaccuracy or report back to you why they refuse to change the reporting. Let us review your credit reports for free and see if we can find inaccuracies on it. If we do, we can usually get you monetary damages, a clean credit report along with our costs and attorneys’ fees.

What Our Clients Say About Our Credit Repair Lawyers

With the assistance of Credit Repair Lawyers of America, I have learned to be patient, ask questions and let the professionals do their job. They identified a major error on my credit report, and as a result, I am more conscientious and knowledgeable about what’s entailed on my credit report. The process seemed long but there was a lot of work going on behind the scenes. Thanks Credit Repair Lawyers of America, you are appreciated.

Thanks Credit Repair Lawyers of America, you are appreciated.

Yolanda Harrel-Fenton

★★★★★

They been helping me for years monitoring my credit and fixing error I don’t catch, great team.

Katy Rodriguez

5.0 ★★★★★

I love the results that I received from Credit Repair Lawyers. All my questions were answered and I didn’t have to wait.

Carla Piersen

5.0 ★★★★★

This company was very helpful with my case. They kept me informed and it was a very smooth experience.

Quonya Williams

5.0 ★★★★★

We File Lawsuits On Behalf Of Our Clients Against Credit Reporting Agencies, Creditor, Or Debt Collector

At Credit Repair Lawyers Of America, we are not afraid to stand up to the big credit bureaus and creditors. Our attorneys have filed lawsuits against Equifax, Experian, and TransUnion. We will take whatever legal action is necessary to get the job done right.Our lawyers understand the laws and regulations governing credit reporting and credit repair. We know your rights under the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA), and we will use these laws to get results for you.

Contact California’s Leading Credit Repair Lawyers

Schedule A Free & Confidential Case Consultation Today!

Call us today for a fee, no obligation consultation. Let us review your credit reports for free. We can send up to 3 dispute letters (1 to each credit bureau) on your behalf for free. If we have to file a lawsuit, we will only look to the defendants to pay our fees and costs so nothing comes out of your pocket. You can also email us for more information at [email protected]. Call us today

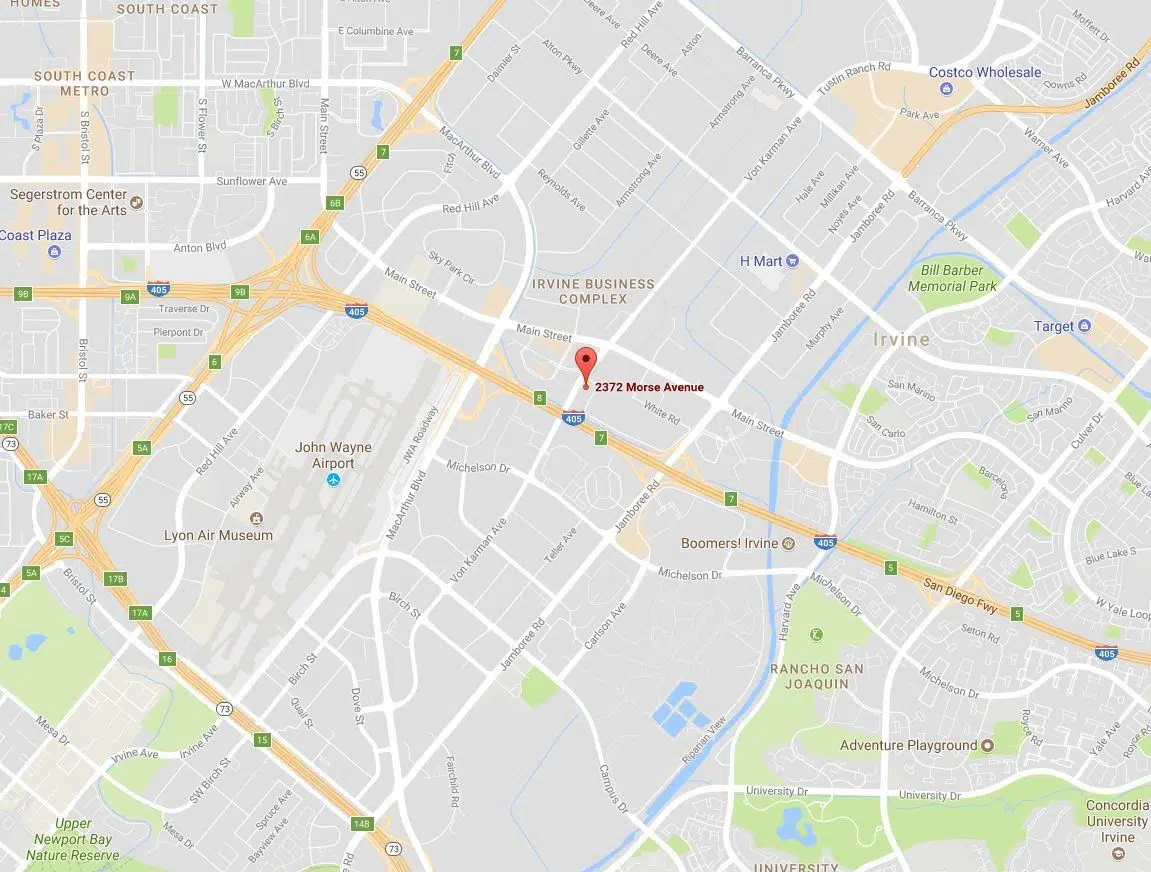

Credit Repair Lawyers of America

2372 Morse Ave, Ste. 293

Irvine, CA 92614

[email protected]

creditrepairlawyersam.com

HOURS OF OPERATION

Monday to Friday: 8:30 AM to 5:00 PM

Weekends: By Appointment Only