Top-Rated Illinois Law Firm

Representing Victims Of Identity Theft

With The Internet & Emerging Technologies, The Risk For Identity Theft Increases

We have been cleaning up credit reports from identity theft since 2007. We have gone after the credit reporting agencies and lenders when they refuse to clean up our clients’ credit reports. The best part is that we make them pay our fees and costs so it costs you nothing out of pocket.

Resolve Issues With Creditors and Collection Agencies

Many times creditors and collection agencies refuse to believe that our clients are truly the victims of identity theft. We make believers out of them when they refuse to remove the negative information from credit reports caused by identity thieves. We file lawsuits that cost our clients nothing out of pocket. We collect our fees and costs from the lenders and credit reporting agencies that we sue.

Negotiating With Credit Card Companies For Resolution Of Fraudulent Charges

Under the law, if a fraudulent charge appears on your credit card statement, you have the right to dispute it within 60 days of when the bogus charge appears. Many times, even if you timely dispute the charge, the credit card company will give you a hard time. That’s where we come in. We sue the lenders and credit card companies and make them not only remove bogus charges from your credit card account, but we also make them pay our fees and costs. Again, our services cost you nothing out of pocket.

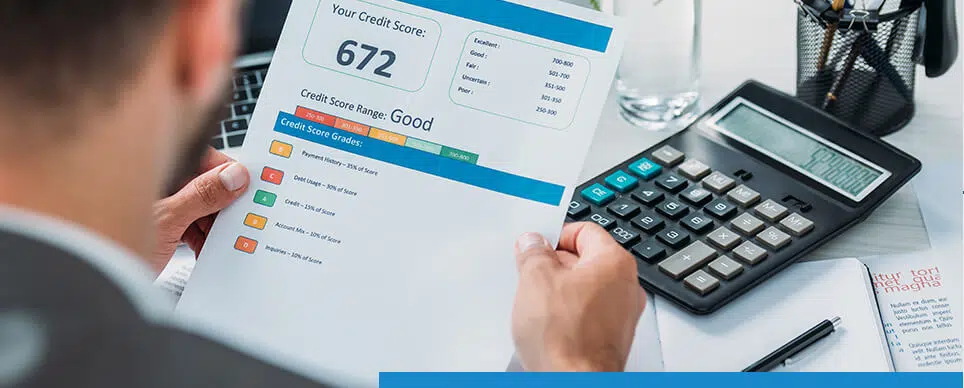

Repair Your Damaged Credit Report Caused By Identity Theft

Identity theft is still the fastest growing crime in Illinois and around the country. It has been the fastest growing crime in the last decade. There is no sign of it slowing down. In our experience, there are 2 kinds of people walking around; those who have had their identities stolen and those who WILL have them stolen. The question is what will you do when it happens to you? Call us. We will help you through it at no out of pocket charge to you.

Has Your Credit Been Hurt Because Someone Stole Your Identity?

Our Firm Assists Consumers Restore Their Credit After ID Theft

This is exactly what we do. We have been repairing credit reports since 2007. We know exactly who to contact and how to reach them to get your credit report back on track after it has been hijacked by an identity thief. Under the law, our services will cost you nothing out of pocket.

How Our Identity Theft & Credit Repair Lawyers Can Help

Take Action & Dispute Credit Report Errors Today

If your identity has been stolen, you need to get a copy of all 3 of your credit reports. Go to AnnualCreditReport.com and get a copy of your actual credit reports. Next, review each credit report and circle the bogus tradelines, addresses, name variations on it. Then go to your local police station and make a police report. Be sure to identify every incorrect item on your credit reports in the police report. Finally, call us. We will take it from there for you at no out of pocket charge to you.

Identity Theft Can Happen To Anyone

Our Illinois Law Firm Mobilizes To Repair Our Client’s’

Credit History & Reputations

Unfortunately, many of our clients first learn that their identities have been stolen when they apply for a car, apartment or a mortgage loan. It’s not only embarrassing, but often, depressing to be denied credit for something.

Illinois Credit Repair Lawyers For Identity Theft Victims

Get The Exceptional Legal Representation You Deserve

Call us and we will act quickly to fix your credit report so you can proceed with your dream purchase.

Frequently Asked Questions About Our Illinois Identity Theft Law Firm

What Our Clients Say About Our Credit Repair Lawyers

With the assistance of Credit Repair Lawyers of America, I have learned to be patient, ask questions and let the professionals do their job. They identified a major error on my credit report, and as a result, I am more conscientious and knowledgeable about what’s entailed on my credit report. The process seemed long but there was a lot of work going on behind the scenes. Thanks Credit Repair Lawyers of America, you are appreciated.

Thanks Credit Repair Lawyers of America, you are appreciated.

Yolanda Harrel-Fenton

★★★★★

They been helping me for years monitoring my credit and fixing error I don’t catch, great team.

Katy Rodriguez

5.0 ★★★★★

I love the results that I received from Credit Repair Lawyers. All my questions were answered and I didn’t have to wait.

Carla Piersen

5.0 ★★★★★

This company was very helpful with my case. They kept me informed and it was a very smooth experience.

Quonya Williams

5.0 ★★★★★

Take Action Now

Contact Our Experienced Illinois ID Theft Lawyers Today

Call us at (312) 647-7380 for more information. You can also email us at [email protected] for more information. We are happy to give you a free, no obligation consultation.