Being Charged Monthly For Credit Repair? That’s Illegal.

The Federal Trade Commission has made it illegal for “for profit” credit repair companies to charge fees to consumers until 6 months after the credit repair company has provided all of the promised benefits.

Best Reasons Why You Should Not Pay For Credit Repair

Most Credit Repair Companies Are Running Illegally

The Federal Trade Commission has made it illegal for “for profit” credit repair companies to charge fees to consumers until 6 months after the credit repair company has provided all of the promised benefits

This is a rule under the FTC’s Telemarketing Sales Rules (“TSRs”). Most credit repair companies charge a monthly fee to their clients for writing dispute letters. This is just illegal. The CFPB and FTC have filed numerous lawsuits against credit repair companies for running such illegal practices.

Most recently, the CFPB filed a lawsuit against a company called Credit Repair Cloud and its owner, Daniel Rosen, just for writing software that supports credit repair companies and people who do not observe the TSRs. The CFPB has now expanded its manhunt to not only credit repair companies that don’t follow the TSRs, but to companies that provided “substantial support” to those companies as well. Consumers who pay for these services could be next.

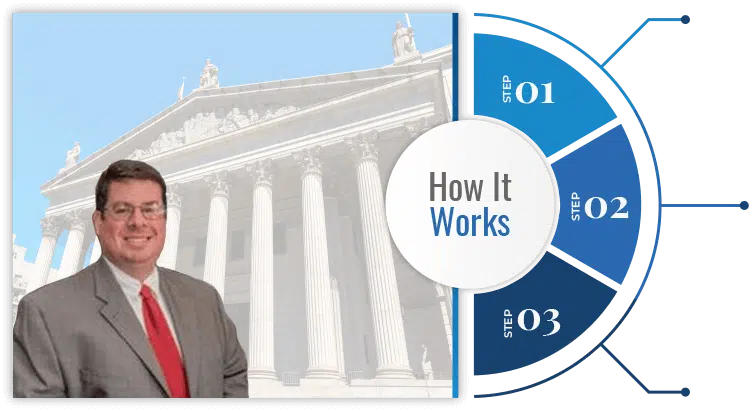

Our Credit Repair Process

Step 1 CRLAM reviews your credit report for errors so we can assist you in resolving them – we get our fees from the settlements from the credit bureaus and creditors that have wronged you, If there is no settlement there is no fee to our client.

Step 2 CRLAM provides you with up to three free dispute letters, designed to force these companies into rectifying the mistakes on your credit report.

Step 3 If for any reason they do not resolve these issues even after being sent these dispute letters via certified mail, we can then sue them for you and if you get a monetary settlement we would only then get paid out of those fees.