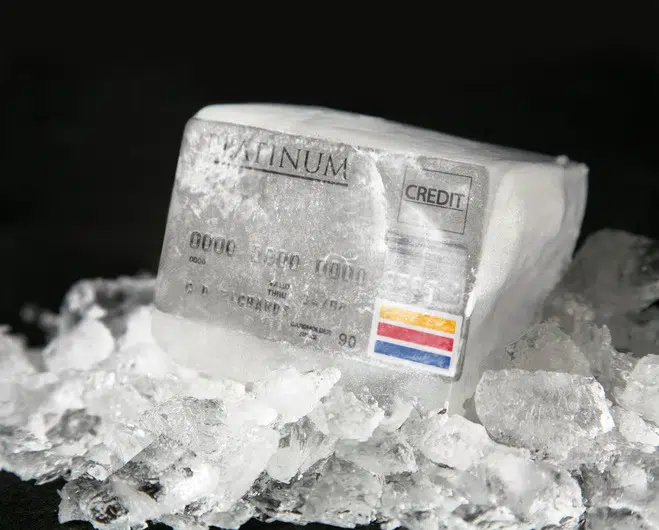

Many Ohio consumers were unfamiliar with credit freezes until after the massive Equifax data breach was made public. Then, suddenly, “credit freeze” started trending on social media as seemingly everyone in Ohio and throughout the country made a dash to freeze their credit reports. Because the Equifax hack left about 143 million Americans with exposed personal data, this panic is understandable. However, the rise in popularity of credit freezes has made some consumers worried about how this trend might impact the U.S. economy. Obviously, consumers freeze their credit in order to prevent identity thieves from opening fraudulent accounts in their names. However, a credit freeze also disables a consumer’s own ability to take out new credit. With so many consumers in Ohio and elsewhere temporarily blocked from getting loans or credit cards, will the U.S. economy weaken?

Experts Weigh in on the Possible Impact of Increased Credit Freezes on Consumers in Ohio and Other States

The good news for concerned Ohio consumers is that most experts don’t believe that the sudden rise in credit freezes will have a negative impact on the U.S. economy. In fact, these credit experts think that the trend might actually help consumers in two ways.

Some Ohio residents may avoid new debt.

Of course, Ohio consumers who freeze their credit will unfreeze it to take out necessary loans and apply for needed credit cards. Having to go through this extra step may, however, prevent them from impulsively taking out store credit cards. If this is true, these individuals might avoid building high-interest credit card balances that could cause financial issues and lower credit scores down the road.

Identity theft may actually go down.

Even before the Equifax data breach, reported incidents of identity theft in Ohio were alarmingly high. Therefore, it seems like, with so much consumer information suddenly exposed, a bad problem would just get worse. Yet, some experts say that credit freezes and hypervigilance with credit reports may actually pay off. Because Social Security numbers were stolen, the threat of increased identity theft will remain for years. Therefore, only time will tell whether or not extra consumer awareness will yield positive results with identity theft protection.

Whether they opt for credit freezes or not, all Ohio consumers should stay on top of their credit reports. By regularly checking their credit reports, consumers can identify the fraudulent accounts and bogus transactions that typically indicate identity theft. Credit report monitoring also allows Ohio residents an opportunity to find errors caused by creditors and the credit bureaus. As everyone knows at this point, the credit reporting agencies are absolutely NOT perfect. Also, their mistakes shouldn’t cost you credit score points.

If you find errors and mistakes on any of your credit reports, call the Law Offices of Gary D. Nitzkin, P.C. When you contact our firm, an experienced credit attorney will get you clean credit reports for FREE. Even if we need to file lawsuits on your behalf against the credit bureaus, we never charge our clients anything out of pocket for our services.

The Free and Legal way to Get Better Credit

Don’t let errors on your credit reports bring your credit score down. At the Law Offices of Gary D. Nitzkin, P.C., we’ve been cleaning up credit reports for consumers since 2008 for free. How do we do it? The law allows us to collect our fees and costs from the defendants in any successful action. This is why our clients pay nothing for the work we do.

Let’s start the conversation about what we can do for your credit. Set up your free consultation today by calling Attorney Gary Nitzkin at (480) 771-6001 or sending him a message through our contact page.

For more information about Free Credit Repair, please visit https://creditrepairlawyersam.com/ohio/credit-repair/.