Late credit card payments hurt credit scores, but the damage doesn’t happen right away. This is why Minnesota consumers who accidentally miss a due date should act fast to correct the problem. If you make the missed payment in full and quickly enough, you probably won’t face a delinquency on your credit report. This means that your credit score won’t take a hit. However, Minnesotans who are 30, 60, 90, 120,150, and 180 days late with credit card payments can cause long-lasting damage to their credit scores.

What Happens When Minnesota Consumers are a Little Late or Very Late with Credit Card Payments

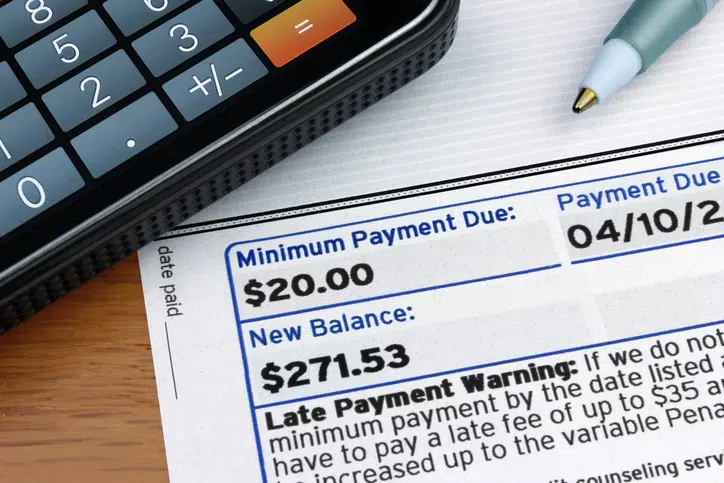

No one likes paying extra, and you should keep this in mind when organizing your monthly payment schedule. The truth is, even if you are just a little late with your credit card payments, you will face a late fee. Sure, this is a nuisance for Minnesota credit card users who allow a due date to slip by, but it is a fairly minor penalty. If you simply pay the fee along with the full amount of the missed payment within a few days, or even a couple of weeks, you can at least protect your credit score.

If, however, you let more time pass without making a payment, the consequences get much worse. In fact, after 30 days of non-payment, most tardy Minnesotans see a decrease in their credit scores. This is because most credit card issuers report late payments to the credit bureaus after they are 30 days late. At this point, the late payment is reported to the credit bureaus, and this negative item may stay on your credit reports for seven years. This happens even if you eventually make things right with the credit card company.

A few creditors don’t report tardy credit card payments until they are 60 days late. However, it is unwise for Minnesota consumers to push their luck unless they are very familiar with their issuer’s policies. For the majority of creditors, a 60-day late payment prompts a second report to the credit bureaus. Then, subsequent black marks appear at the 90, 120, and 150 marks. After 180 days of non-payment, the account is normally written off and turned over to a debt collection agency.

Other Consequences Consumers Face for Late Credit Card Payments in Minnesota

It usually takes Minnesota consumers with credit card accounts in debt collections a long time to achieve full credit recovery. Having a written-off account in your credit history makes you look like a risky borrower. Therefore, if you have this type of item on your credit reports, you may have a difficult time getting approved for loans and new lines of credit.

Even before getting to the point of no return called the charged-off account, late-payers are likely to face expensive consequences. First, late fees can add up, effectively making everything charged on your credit card cost more. Also, depending on your agreement, your issuer might enforce a penalty interest rate when you are over 60 days late with your credit card payments. Usually, even if card users bring their accounts back to good standing, these higher rates persist. Most credit card companies enforce penalty interest rates until the tardy consumer makes six consecutive payments on time.

What Minnesotans Should do When Credit Card Payments are Wrongfully Reported as Late

When it comes to handling consumer information, creditors and the credit reporting agencies aren’t always perfect. Unfortunately, a lot of Minnesota consumers who pay their credit card payments on time end up with a late payment on their credit reports by accident. If this happens to you, or if you find any other errors on your credit reports, call Credit Repair Lawyers of America in Minnesota.

Our team of experienced credit repair attorneys will fix the credit problems that are possibly hurting your credit score for FREE.

The Free and Legal way to Get Better Credit

Don’t let errors on your credit reports bring your credit score down. At Credit Repair Lawyers of America, we’ve been cleaning up credit reports for consumers since 2008 for free. How do we do it? The law allows us to collect our fees and costs from the defendants in any successful action. This is why our clients pay nothing for the work we do.

Let’s start the conversation about what we can do for your credit. Set up your free consultation today by calling Attorney Gary Nitzkin at (612) 235-4458 or sending him a message through our contact page.