Since 1956, the FICO score has served as the go-to credit score for mortgage lenders. Now, the mortgage lobby says that the FICO scoring model is outdated. Even though the FICO score has evolved through the years, it still relies heavily on consumer credit history. For this reason, some mortgage experts believe that FICO scores prevent many first-time buyers in Pennsylvania from getting home loans. This is why they want lenders to use credit scores based on alternative data, like utility bill payments, job history, and residence stability.

Credit Score Alternatives to the FICO Score for Mortgage Lenders in Pennsylvania

Of course, newer versions of the FICO credit scoring model use at least some alternative data. However, most lenders haven’t switched over to these update versions. There are also credit scores available from other sources, such as the VantageScore, which was developed by TransUnion, Experian, and Equifax.

Recently, the Federal Housing Finance Agency (FHFA) wrote a letter to Fannie Mae and Freddie Mac, expressing its concern over the “outdated” FICO score. The FHFA believes that the government-sponsored lenders are doing a disservice to certain would-be homebuyers. By using older versions of the FICO score, lenders frequently turn down Pennsylvania consumers with thin credit files. This, the FHFA argues, is unfair to immigrants and younger Pennsylvanians.

In Pennsylvania and across the country, homeownership is at a 50-year low. This is why several trade groups and multiple consumer rights groups signed the FHFA letter. This isn’t a new battle, though. These mortgage and consumer advocacy groups have put continuous pressure on Fannie Mae and Freddie Mac for about four years. Yet, in spite of this pressure, the lending organizations are not responding with urgency. In fact, they insist they won’t consider taking on a new scoring model until mid-2019, at the earliest.

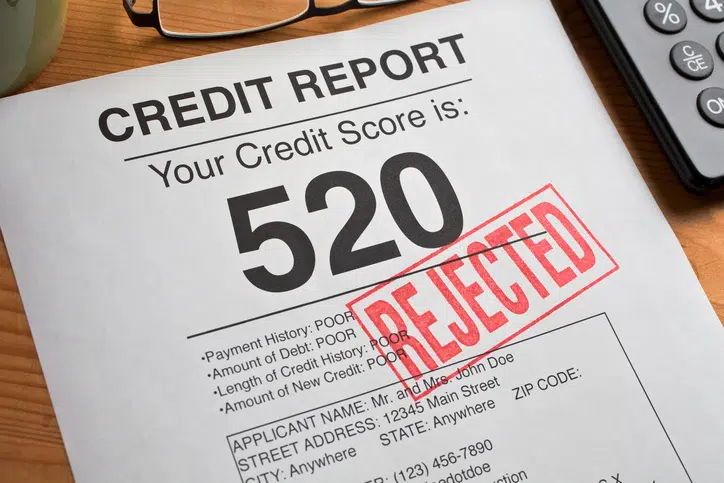

How Pennsylvania Consumers Can Boost their Credit Scores before Getting a Mortgage

A lot of would-be homeowners in Pennsylvania can’t wait until mid-2019 to get a mortgage. For these consumers, there are ways to boost credit scores in order to qualify for a home loan. First, make sure that all of your bills are paid on time. Next, pay down high credit card balances so that you’re only using 30% of your available credit. If you don’t have a credit card, consider getting one for limited use, and pay off the balance every month. For Pennsylvanians who have bad credit, secured credit cards and subprime credit cards are possible options.

Finally, check your credit reports for mistakes and errors. About 80% of Pennsylvania consumers have flaws on their credit reports. Unfortunately, many of these inaccuracies bring credit scores down. Checking your credit reports is easy and free. Under the Fair and Accurate Credit Transactions Act (FACTA), you can request complimentary copies of your credit reports from the three major credit bureaus every 12 months. Just go to www.annualcreditreport.com to pull credit reports from TransUnion, Experian, and Equifax.

Pennsylvanians who find errors on their credit reports should dispute them and have them removed. However, this advice comes with a big caveat for potential homebuyers. Namely, YOU CANNOT GET A MORTGAGE IF YOU HAVE OPEN DISPUTES ON YOUR CREDIT REPORTS. Because of this rule, credit recovery must happen well in advance of home loan applications. Get your credit reports fixed first, then apply for a mortgage. On the other hand, if you have open disputes on your credit reports, and creditors won’t remove them in spite of your requests, this is problem. Luckily, Credit Repair Lawyers of America can help with both issues.

How Credit Repair Lawyers of America Helps Homebuyers in Pennsylvania

The experienced credit attorneys at Credit Repair Lawyers of America in Pennsylvania can remove mistakes and errors from your credit reports – for FREE. Also, for no charge, we can get disputes taken off your credit reports and allow you to move forward with your mortgage application. Either way, a credit lawyer from our firm will help you get clear credit so that you can achieve your goal.

Don’t let errors on your credit reports bring your credit score down, and don’t allow open disputes prevent you from getting a mortgage. At Credit Repair Lawyers of America, we’ve been cleaning up credit reports for consumers since 2008 for free. How do we do it? The law allows us to collect our fees and costs from the defendants in any successful action. This is why our clients pay nothing for the work we do.

Let’s start the conversation about what we can do for your credit. Set up your free consultation today by calling Attorney Gary Nitzkin at (856) 912-3511 or sending him a message through our contact page.